Sign up today

Make the switch to cheaper, cleaner, fairer power. Discover your prices.

My Account

Track your usage and spend, pay your bill, tell us you’re moving, and more.

Adrian Merrick, Energy Locals Founder and CEO

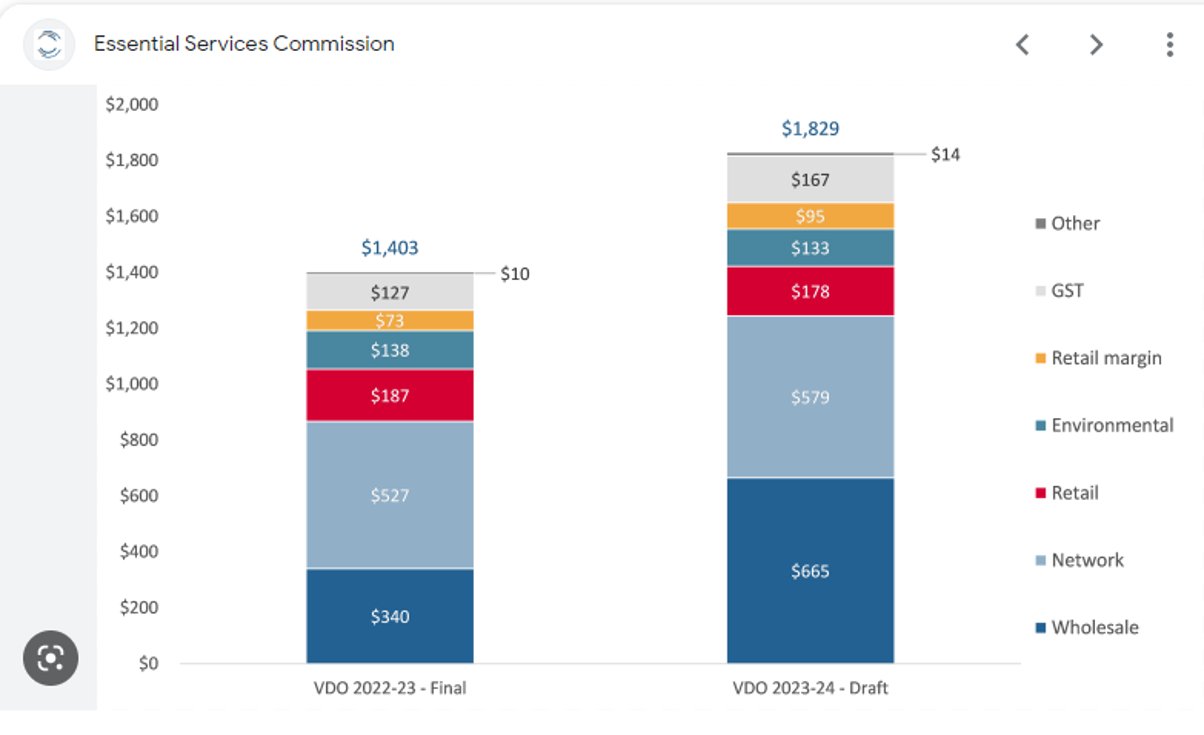

Let’s start with the draft Default Market Offer (DMO) and the Victorian Default Offer (VDO) which have been released in draft form for the 2023-2024 period.

What does that mean, you might be asking? Well, the DMO and VDO are maximum price caps that energy retailers can charge for standing offer customers in NSW, South East QLD and South Australia (DMO) and Victoria (VDO). They’re designed to help protect consumers from getting ripped off and make it easier to compare different energy plans. An interesting bit of history is that some retailers used to make ‘percentage off usage’ discounts look great simply by artificially inflating the price the discount is off. For customers that didn’t get the discount or stopped paying attention, they’d therefore pay some truly mind-blowing prices. That’s been fixed thanks to the DMO and VDO.

This year reflects the madness of the global energy market over the past year. I’m going to avoid mentioning the ‘U’ word as the conflict in Europe has been unfairly blamed by traditional energy companies for prices rising, which has only partially been the case. However, companies that run traditional power stations and produce gas have made the most of the situation and wholesale energy prices jumped dramatically during this financial year. They’ve started to recover, but the wholesale cost jump is still flowing through. As a result, the DMO and VDO are set to increase as well. That’s because around 30-40% of a normal energy tariff is based on wholesale costs.

The unfortunate news is that because of this us and other retailers will have to pass on these higher prices in August. But rest assured we’ll be doing everything we can to keep these costs down as much as possible and continue to provide fair solar feed in tariffs.

They did, and it made a significant and positive difference. Back in December, the federal government stepped in and did something pretty unusual: they set temporary limits on the prices of gas and coal in the wholesale market. Basically, they said that the prices couldn’t go above $12 per gigajoule for gas and $125 per tonne for coal. However, these price caps only applied to the local market, not to any contracts for exporting these resources.

So why did the government feel the need to step in like this? Well, the prices of thermal coal and liquified natural gas (LNG) had skyrocketed over the past year – more than tripled in fact – due to supply chain issues and overseas demand. This meant that it was costing power stations a lot more to generate electricity, and those costs were being passed on to retailers and consumers. And boy, did we all feel it!

Now, you might be wondering why the power stations didn’t just absorb those extra costs themselves, instead of making us pay for it. Well, there are a couple of possible explanations. One is that they didn’t have very good “hedging” strategies in place – in other words, they didn’t buy enough fuel ahead of time at lower prices to offset the higher prices later. Why you’d run a power station that can’t actually do anything without fuel, and not ensure you’ve secured fuel for it, is totally beyond me though. The other possibility that some people have speculated is that they were taking advantage of the situation and trying to make a bigger profit for themselves. I think we all know what the bigger influence may have been.

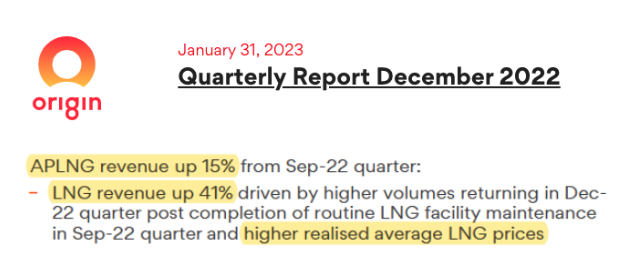

Meanwhile, like turkeys asking everyone to cancel Christmas, gas producers were arguing that the government shouldn’t intervene – they claimed that there was actually plenty of gas available for domestic use, over 110 petajoules’ worth! That’s enough to meet the needs of residential and commercial customers in New South Wales for a whole year. The problem was that the price of gas being offered overseas was much higher than usual – between $30 and $40 per gigajoule, instead of the usual $8 to $12. So guess where they sent most of their gas. Yep, on a ship. That’s ok and exports of various products are a huge part of the Australian economy, but not if the natural resources that underpin essential services are priced out of reach of many customers. Some companies even went so far as to brag about profits from shipping gas overseas on the very same day as jacking up customer prices:

You couldn’t make it up. And they weren’t alone: Energy Australia increased its gas prices in NSW by a whopping 26.7%, although they don’t send gas overseas.

Anyway, the government decided to step in and set those temporary price caps to try to help ease the burden on consumers. And it has worked, just not as much as we’d like, partially because gas producers all but stopped offering new gas contracts. After all, you don’t need to worry about a price cap if you don’t sell it in Australia

The market cap on coal should’ve resulted in a cost to generate electricity of $75-80 per MWh, but the wholesale market is still trading at a 50% premium to that. This means that the cost of generating electricity is still higher than it should be. We hear that some generators are pricing in the uncertainty of future government regulation.

Meanwhile, the gas market has come to a grinding halt as producers await the government’s code of conduct. The code will require them to supply gas at prices that reflect the cost of domestic gas production, allowing for a reasonable return on capital. The big gas producers aren’t thrilled by this as they’d be forced to sell at reduced profit margins with rules and regulations that are still uncertain. For that reason, it continues to be hard for large gas customers and retailers to source gas.

And while we’re on a roll, the electricity contract ‘futures’ market, which allows retailers to protect themselves and their customers from volatile prices, continues to be inaccessible for many retailers. The futures market is the plumbing that’s used by both retailers and generators to prudently manage their wholesale risk. However, accessing the market price has been problematic for most, which means that retailers and generators are unable to effectively manage their risk and access the lower power prices.

All in all, it’s a complicated situation. The government’s intervention has provided some welcome price relief for electricity, although the market remains elevated vs 18 months ago. But the gas market is still struggling, and the futures market is clogging up the system which is likely to result in reduced competition.

We all know we need to transition to clean energy to protect the planet. The problem is that there’s not enough clear policy on how to make this happen. This creates uncertainty for companies involved in energy production, which means they might charge more for energy to make sure they can still make a profit.

The government is trying to help the transition by encouraging the use of gas as a “bridge” fuel between fossil fuels and renewables. But there’s a catch according to the market operator AEMO – at least one State might run out of gas soon! The Bass Straight gas fields are getting old and tired, which means new sources are required. Whether we like it or not, and frankly we don’t, we’re going to need some new sources of gas to get us through the energy transition process.

There’s a bit of a debate happening about whether we should extend the life of an old black coal power station, Eraring, to help the transition. Again, while we don’t like the answer, the only rational answer to ensure the lights stay on in the short term is ‘yes’. But we’d like it to happen by the NSW Government pressuring Origin to use its ‘social licence’ and not as a result of a secret payment of taxpayers’ hard earned money to a company that already has enough, as happened to our disappointment in Victoria

Renewables make sense for customers and the companies who invest in them. For large-scale renewables, we’d like to see the approval process shortened as red tape-driven project delays leads to higher prices for customers. More supply = lower prices.

We’re constantly thinking ahead when it comes to securing our energy sources. We want to make sure that we’re able to offer our customers the best possible rates, while also doing our part to transition to renewable energy.

One way we’re doing this is by being smart about how we manage our wholesale exposure. Basically, this means that we’re buying our energy well in advance at the best prices available, so that we’re not caught off guard by sudden price increases. We want to make sure that we’re always in a position to offer our customers the best possible deal. Since we launched, we’ve only ever updated our prices once each year and intend that to continue via this prudent approach.

But we’re not just thinking about the present – we’re also looking towards the future. We’re actively having conversations with renewable energy providers to secure more access to clean energy sources that we can offer to our customers. We believe that by working together with these providers, we can help to bring on more renewable energy and make a real difference in the fight against climate change. In the meantime, we’ve installed 2050kW of solar PV and 555kW* of battery storage in apartment buildings, including the two largest residential Tesla Powerwall installations in the country. And there’s plenty more in the pipeline.

So that’s what’s happening in a slightly crazy energy market and what we’re doing about it at Energy Locals – we’re thinking ahead, and working to secure more lower carbon energy sources for our customers. Thanks for supporting us on our mission to make affordable clean energy a reality!

If you would like to join our community you can switch in minutes here.

*This figure is inclusive of end of April 2023